THE SHP FINANCIAL BLOG

At SHP Financial, we focus on a customized investment and retirement strategy to help get you retired, and stay retired. To help you better understand your financial needs or assess your current investment and retirement strategies, we post a weekly blog. We hope you find these retirement and financial insight blogs helpful, and if you would like to take it a step further for a complimentary review of your current strategies, you can click to let your journey begin.

Weekly Market Thought of the Week – Markets Rally

The stock market staged a broad rally this week, buoyed by the prospect that COVID-19’s grip on the nation may be easing and news of another Federal Reserve program to help stabilize businesses. The Dow ...

3 Unprecedented Measures During the Coronavirus Pandemic

We’re living in unprecedented times, and the government is taking unusual steps to mitigate the economic damage done by the coronavirus. Strict measures are in place, like canceling events of more than ten people, closing ...

Weekly Market Thought of the Week – Special Update: Quarterly Report

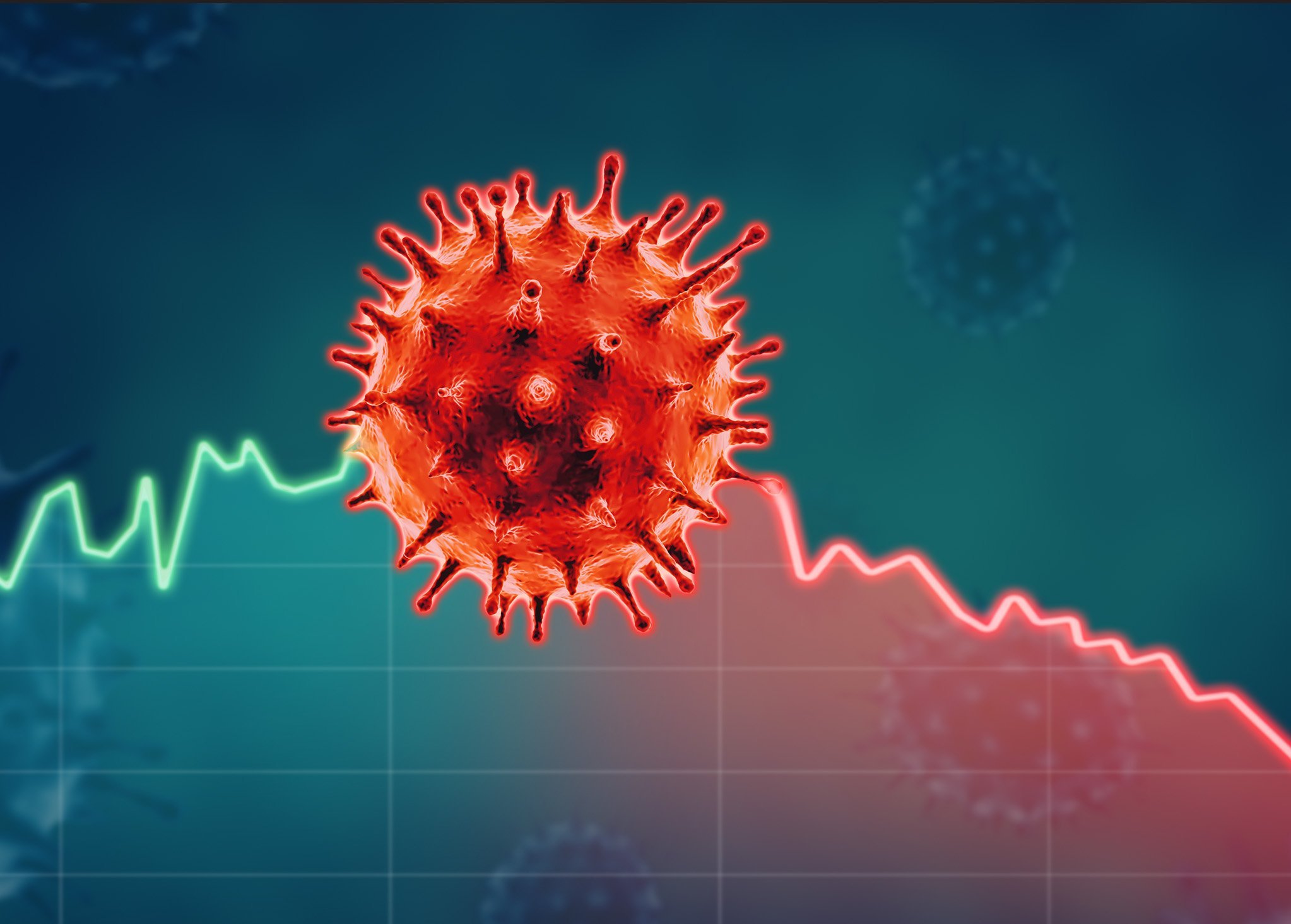

Modest declines in stock prices this week masked the volatile inter- and intraday price swings as investors digested poor economic data and a warning from the president that the worst days of the COVID-19 pandemic ...

Do’s and Don’ts in a Volatile Market

If the state of the market has caused you to worry, you’re probably not alone. The coronavirus and falling oil prices have caused many to panic. In times of uncertainty, it can be easy to ...

Weekly Market Thought of the Week – Congress Approves Stimulus

An open-ended commitment by the Federal Reserve to support American businesses and capital markets along with the passage of a $2 trillion aid package improved investor sentiment and drove a strong rally in stock prices. ...

What Is a Bear Market and How Long Does It Last?

During this period of volatility, many are asking where the economy is headed. As the coronavirus affects the U.S. financially and socially in a way previously unseen, lawmakers are acting to boost the economy, and ...

Low Interest Rates, Market Volatility, and Your Retirement

Planning for retirement is never a "set it and forget it" activity. There are unexpected disasters, market drops, and changing laws that invariably cause retirees to reevaluate their plans of action. Recently, market volatility and ...

Weekly Market Thought of the Week – More Coronavirus Volatility

The stock market suffered through another volatile week as it wrestled with the health and economic fallout of the domestic spread of the coronavirus. Swift and decisive actions by the Federal Reserve and policy responses ...

Coronavirus Correction

The events over the last few weeks remind us that no one can predict the ups and downs of the stock market. While there’s abundant information out there to reference so you can make informed ...

Weekly Market Thought of the Week – Volatility Continues

Markets remained exceptionally volatile, buffeted by the spreading impact of coronavirus, uncertain responses from federal policymakers, and the sudden drop in oil prices. The Dow Jones Industrial Average fell 10.36%, while the S&P 500 declined ...

New Year, New Law Pt. 4: 4 Ways the SECURE Act Could Affect Your 401(k)

Here’s proof that funding retirement has changed: In 1970, 45% of private sector employees were covered by a pension plan.[1] Now, 4% are covered.[2] Pensions have largely been replaced by 401(k), IRAs, and similar retirement plans, ...

Weekly Market Thought of the Week – Rallies and Retreats

Heightened coronavirus fears, falling yields, and Super Tuesday primary results sent stocks on a rollercoaster ride of sharp price swings, leaving stocks marginally higher for the week. The Dow Jones Industrial Average improved 1.79%; the ...