THE SHP FINANCIAL BLOG

At SHP Financial, we focus on a customized investment and retirement strategy to help get you retired, and stay retired. To help you better understand your financial needs or assess your current investment and retirement strategies, we post a weekly blog. We hope you find these retirement and financial insight blogs helpful, and if you would like to take it a step further for a complimentary review of your current strategies, you can click to let your journey begin.

3 Things to Keep in Mind When Estate Planning

Estate planning is an important part of retirement planning for many reasons: You’ve worked hard for your money and want to see your children and grandchildren benefit. And, you want to see it passed down ...

A Change to Social Security

Social Security may be in jeopardy: The latest projection from the trustees of Social Security and Medicare shows that the program won’t be able to pay out full benefits by 2035 if Congress makes no ...

Weekly Market Thought of the Week – Weathering the Storm

Remember the adage, “March comes in like a lion and goes out like a lamb”? It certainly held true for the market this year; we gently entered the second quarter following the first quarter’s relatively mild volatility ...

The Power of Nostalgia

You might think that the more recent an event, the easier it would be to remember it. And you might think that things that happened to you a long time ago would be harder to ...

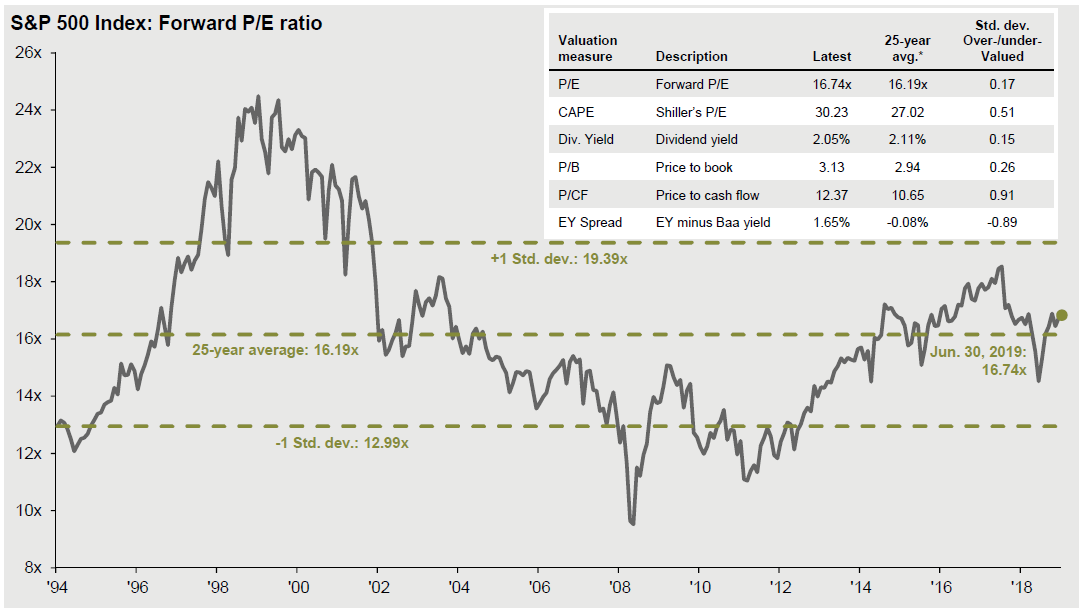

Weekly Market Thought of the Week – Weekly Market Recap

The S&P 500 Index surpassed the 3,000 level for the first time ever as Federal Reserve Chair Powell’smonetary policy testimony to Congress further bolstered the case for a rate cut late this month, U.S.-China trade ...

Aging in Place

Many homeowners age 50 and older say that they want to “age in place,” but the reality is that many homes were not built to accommodate the needs of older people. If you want to ...

Weekly Market Thought of the Week – What does the bond market know that the stock market doesn’t?

The stock market seems surprisingly fit given that the current economic expansion is entering its 11th year and is now the longest on record. US stocks returned 4.3% in Q2 2019 and are up 18.5% ...

Estate Planning for Your Loved Ones

An estate plan is like a car; it requires regular maintenance, and may need parts replaced as it ages. Some experts recommend reviewing your estate plan every three years, or after a major life event. ...

How to Pass on a Retirement Account

Estate planning is complicated: The fair decision may not actually be the most practical one. What does this mean? It means that even if you divide up your estate equally between your beneficiaries, they could ...

Lifelong Learners: Set Up a 529 Plan for Yourself

Whether you think of yourself as an old dog or spring chicken in retirement is up to you. Even if you don’t retire early, you still have many years ahead of you to enjoy your ...

Weekly Market Thought of the Week – Making Sense of the Fed’s Latest Decision

The Fed on Wednesday held rates steady in its latest meeting. However, in contrast to its previous meetings, the Fed said it was ready to address growing global and economic risks with potential interest rate ...

Caring for Aging Parents

Baby Boomers are sometimes referred to as the “Sandwich Generation,” because many spend time and money care for both their children and aging parents. In fact, according to the Pew Research Center, one in eight ...